The most important points from the second pillar and the Pension Funds Study

The state of the pension funds is an important indicator for the Swiss economy. With this review, we would like to share our findings from the last three decades with you. Find out how the Swiss pension funds have operated over this long period and how this can be used to draw conclusions about the future.

Unique in scope and number of participants

Since its first publication, the Swisscanto Pension Funds Study has been a reliable source of information for all pension funds and is unique in its approach and scope. This has not changed to this day. To the contrary. This is no wonder, as it collects data and facts on a representative group of study participants – large, medium-sized and small pension funds.

The three-pillar principle of pension provision is embedded in the Swiss Constitution.

Compulsory occupational pensions are introduced as funded schemes for the second pillar of the Swiss pension system.

15,000 funds manage total assets of CHF 167 billion. This corresponds to 74% of Swiss gross domestic product.

The promotion of home ownership from funds in the second pillar is introduced.

Divorce law: the revision of the Swiss Civil Code comes into force, which, in the event of divorce, prescribes the division of the second pillar.

First Swisscanto Pension Funds Study

Disclosure of real estate holdings of pension funds by market value

Financial crisis: the coverage ratio of many pension funds falls below 100%. Restructuring becomes necessary for a number of funds.

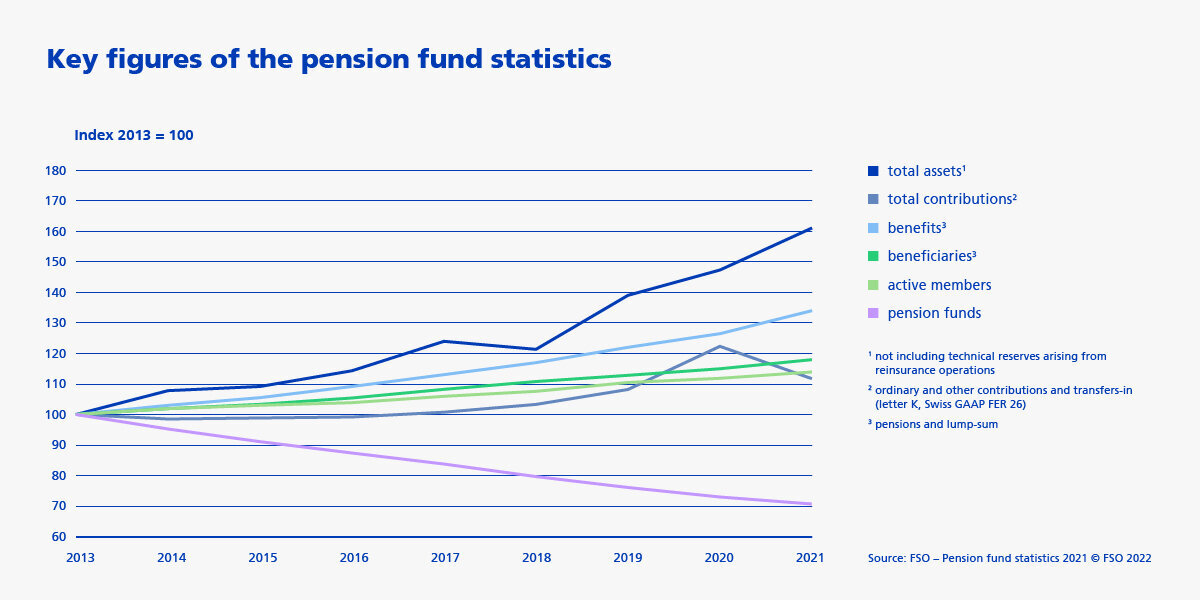

The assets of the Swiss pension funds amount to CHF 621 billion.

The number of funds falls to 2,191.

The yield on 10-year Swiss Confederation bonds falls below 0% for the first time.

- The share of equities in the average asset allocation of pension funds is larger than the share of bonds for the first time.

- Swiss voters (72.7%) reject the BVG pension reform (falling conversion rate, increase in retirement age for women).

- 1e plans are introduced.

- 4.4 million insured persons, 1,434 pension funds and CHF 1,063 billion in assets, corresponding to 141% of gross domestic product.

- The average annual retirement pension from the second pillar amounts to CHF 28,618 (men on average CHF 2,949/month, women CHF 1,547/month).

- The remaining life expectancy of Swiss men is 19.3 years at the age of 65, and 22.2 years for women.

Healthy and robust pension funds: a record high is reached by the average coverage ratio of 122.1% as at 31 December 2021 for private-law pension funds. The value fluctuation reserves have been accumulated up to the target value.

The weak financial markets are affecting the coverage ratios. Bonds did not fulfil their defensive role in the interest rate shock; value fluctuation reserves, on the other hand, did. This means that there is no need for restructuring despite weak financial markets.

Financial markets and coverage ratios are rising again. The recovery is considered fragile in view of the high probability of recession.