Peak in inflation is still to come

The equity markets corrected sharply again in June (-6%). The anxious wait for the peak in inflation and bond yields, as well as interest rate hikes continues. The risks of recession have increased significantly. This will keep weighing on the financial markets.

Text: Stefano Zoffoli

Consumer sentiment sank to an all-time low in the US. the astonishingly robust business climate and purchasing managers' indices have also fallen.

Inflation hasn't peaked yet. In Canada and Great Britain, inflation rates were rising again in June. Since the base effects over the summer months are only very weak, contrary to our previous assumptions we fear that inflation rates in the USA and Europe will only noticeably return in October. It will therefore take longer for the central banks to deviate from their very aggressive path of interest rate hikes.

We consider the current earnings expectations (12% earnings growth for the MSCI World this year) to be clearly too optimistic and therefore expect considerable earnings revisions, which makes valuations seem elevated and the stock markets less attractive. As a result, we need to maintain our defensive positioning for longer than expected.

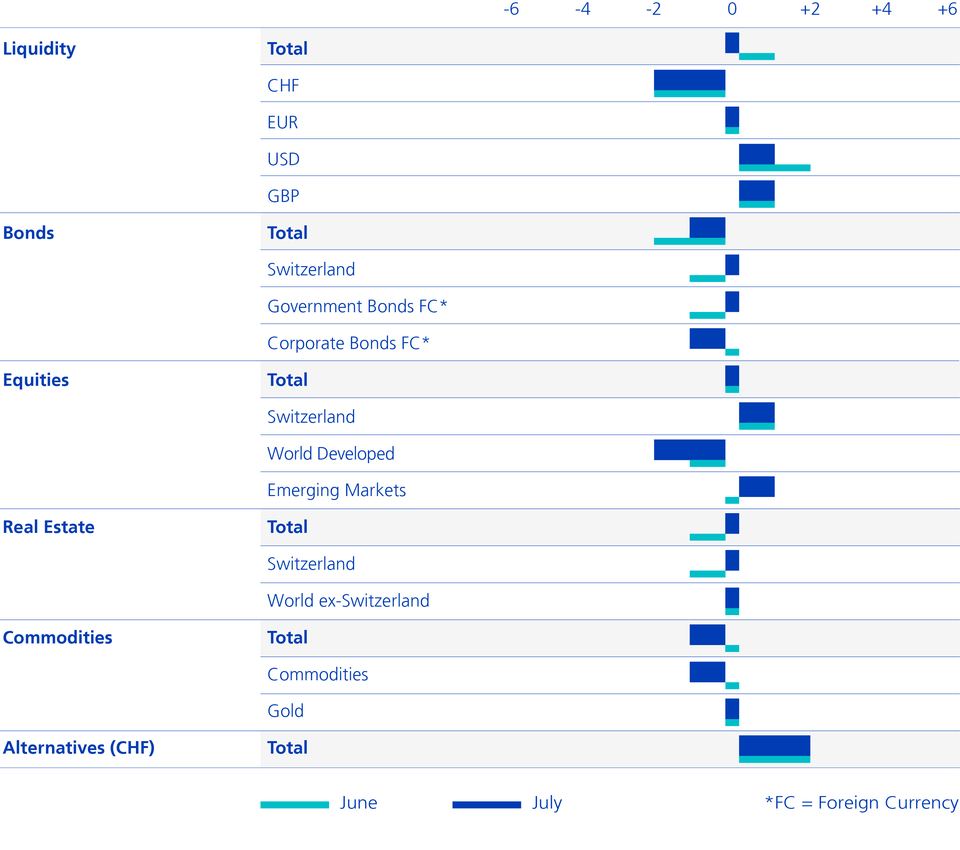

In the short term, however, the markets are heavily oversold; sentiment is extremely pessimistic. Furthermore, since July is seasonally one of the best months on the stock markets, we consider a renewed bear market rally to be probable. We are therefore maintaining our neutral equity allocation for the time being and waiting for a more suitable time for a possible equity reduction.

Unlike equities, the bond market and the commodities market are not yet pricing in a recession. However, this will happen sooner or later. For this reason, we are once again reducing our duration underweight and are now neutrally positioned in government bonds. We are now underweight in commodities. We are increasing Swiss real estate to neutral following the successful underweighting.

- The Swiss franc is no longer overvalued and the SNB is permitting further appreciation. Swiss franc's rise to parity (and beyond) may be permanently. That is why we prefer the CHF.

- Swiss equities are defensive, have very high quality (stable profits and price power) and are a good stagflation hedge. We therefore prefer Swiss equities.

- CHF bonds are now significantly more attractive again after the sharp rise in interest rates at the long end (1.6% since the beginning of the year). Swiss inflation is and remains low by international standards (3% vs. >8% in the USA and Europe).

- After what has seemed an eternity, we are therefore closing our underweight in CHF bonds. Overall, we are therefore also increasing the CHF weighting, in line with the turnaround of the SNB.

- Although the yield premium on high-yield bonds has already risen to over 5%, it does not yet price in a recession. In the past, the yield premium rose to over 9% on average in the event of a recession.

- The nervousness on the market is increasing and a lot of money is flowing out of the asset class. Bonds with a poor rating lose out to a disproportionate degree. The good financing situation – such as the average interest coverage of 6 – could deteriorate quickly.

- We see the risk of credit risk premiums continuing to rise and are therefore selling our tactical position in high yield.

- After nearly 70% losses, Chinese technology stocks have found ground and moved upwards out of their downward-trending channel.

- Valuations have bounced back massively. The average P/E ratio has decreased substantially from 38 to 10. The wave of regulations from the government is abating.

- Unlike developed countries, monetary and fiscal policy in China continues to provide stimulus, which is why we have doubled our tactical position in the Hang Seng Tech Index.

Asset Allocation Multi Asset Solutions