Check our inflation forecast – What has come to pass?

We are reviewing our inflation forecasts from 2020 to reflect the new inflation shock in the US (9.1 percent). Where did we get it right or partially right and where did we get it wrong? We take stock whilst also providing some updates.

Text: Nicola Grass

When we started our multi-part inflation series, kicking it off with the article «The force awakens» (only available in German), inflation rates in the US were below 2%. US inflation has been above the 2% target set by the Fed for 18 months now. Spain even has double-digit inflation and prices are also rising in Switzerland. Although we expressly warned of rising inflation rates in summer 2020 and positioned ourselves accordingly, we did not expect such high inflation rates.

The entire series of articles (only available in German) is listed below:

Inflation – The force awakens

Inflation (II) - Die Büchse der Pandora wird geöffnet

Inflation (III) - Realwerte als Inflationsgewinner

Inflation (IV) - Fear, protect and now unwind

Inflation (V) - Kein Grund für Panik

10 July 2020: «However, this crisis has laid the cornerstone for a long-term rise in inflation.»

10 July 2020: «However, this crisis has laid the cornerstone for a long-term rise in inflation.»

Bull's eye

Inflation rates have risen massively worlwide and are now significantly above the central bank targets.

Update

Structural trends (de-globalisation, de-carbonisation and demographic trends) continue to suggest higher inflation than in the past 20 years. However, inflation rates should come down significantly in autumn/winter 2022/2023 as a result of base effects and recession trends. Next year, we expect US inflation rates to be below 4%.

10 July 2020: «The 10-year US breakeven inflation rate is currently 1.3%, well below the Fed’s inflation target of 2%. (...) The market clearly underestimates the long-term inflation risks. Hence, hedging against inflation is currently very favourable.»

10 July 2020: «The 10-year US breakeven inflation rate is currently 1.3%, well below the Fed’s inflation target of 2%. (...) The market clearly underestimates the long-term inflation risks. Hence, hedging against inflation is currently very favourable.»

Bull's eye

Breakeven inflation rates rose rapidly after the coronavirus crisis and were already back above pre-crisis levels after just five months. For the time being, breakevens even reached 3%, but have been declining again since last April (see chart below).

Update

The long-term breakevens are still well established and, at 2.3%, are also not very high at present. Investors therefore continue to view the high inflation rates as temporary. Due to the increasing risk of recession, downward pressure is likely to continue. For this reason, we have no longer been investing in inflation-linked bonds (TIPS) in recent months. In the event of a further downturn, long-term TIPS will become more attractive again.

10-year US breakeven inflation

10 July 2020: «(...) [we] are seizing this opportunity and investing specifically in real assets at the expense of nominal assets. We are therefore investing in our multi-asset special mandates in gold, inflation-protected bonds, energy commodities, value stocks and small caps.»

10 July 2020: «(...) [we] are seizing this opportunity and investing specifically in real assets at the expense of nominal assets. We are therefore investing in our multi-asset special mandates in gold, inflation-protected bonds, energy commodities, value stocks and small caps.»

Bull's eye

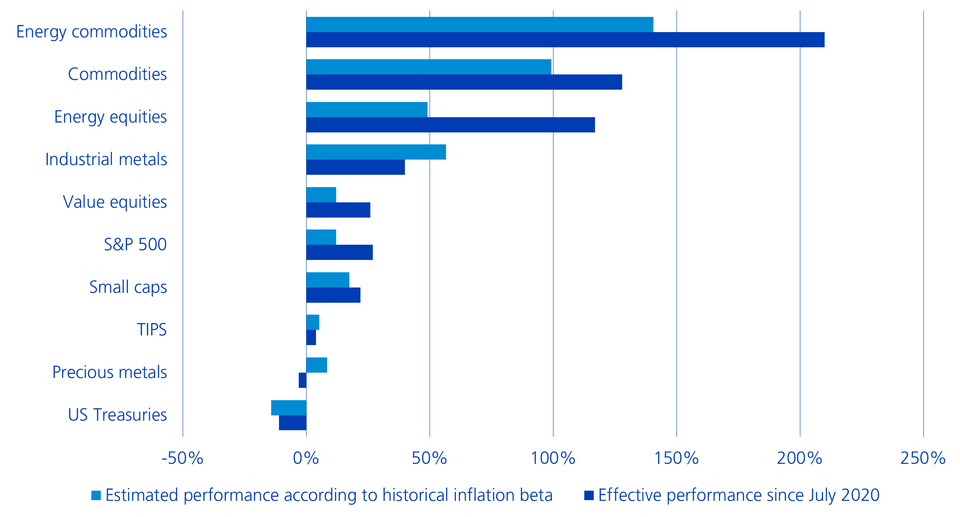

What happens to the return on an asset when inflation rises by 1 percentage point? We explained this correlation, known as inflation beta, in the article at the time and calculated the values for all asset classes. Now that inflation has risen by 7.5% in the US, we can compare these historical averages with the effective return seen since then. The following chart shows that our focus on real assets has paid off, as they have performed significantly better than nominal assets such as US Treasuries since July 2020. In addition, value and energy stocks as well as energy commodities, for example, performed significantly better than expected, while the performance of industrial metals and gold was disappointing.

Inflation protection of various asset classes

Update

Despite supply shortages, the market is likely to become more difficult for commodities now. Spot prices are at an all-time high and recession worries are likely to shift the focus to the demand side. We also do not currently rate gold, small caps and US TIPS as attractive. We are now neutrally positioned again in US government bonds. We are therefore no longer as focused on real assets as we were before.

25 August 2020: «Since rising inflation expectations in the past have led to noticeable foreign currency losses (...) and the costs of a currency hedge are currently very low (...), it is therefore currently advisable to hedge foreign currency risks.»

25 August 2020: «Since rising inflation expectations in the past have led to noticeable foreign currency losses (...) and the costs of a currency hedge are currently very low (...), it is therefore currently advisable to hedge foreign currency risks.»

Bull's eye

The Swiss franc has once again appreciated significantly since summer 2020 (+7%) and hedging costs have remained very low for a long time.

Update

Hedging costs will now increase significantly by the end of the year, at least for the USD. We are therefore no longer strategically hedging commodities and emerging market bonds (both listed in USD). Tactically, we remain overweight in the Swiss franc and see further upside potential, especially against the euro.

24 March 2021: «In keeping with the market saying 'buy the rumour, sell the fact', we are tactically stepping away from the topic of inflation shortly before the anticipated peak of the inflation discussion in early summer this year.»

24 March 2021: «In keeping with the market saying 'buy the rumour, sell the fact', we are tactically stepping away from the topic of inflation shortly before the anticipated peak of the inflation discussion in early summer this year.»

Flop

Our forecast that inflation will peak in summer 2021 turned out to be wrong. We closed the topic too early and underestimated second-round effects on inflation.

Update

We are now already at 9.1% inflation in the US and don't expect it to drop below 8% until autumn.

3 June 2021: «[The higher wages in the US] are mainly due to high compensation payments by the government (...), which will end in September. (...) In the short term, [raw material] prices have already gone too far (...); we therefore do not expect any further pressure on inflation here. (...) We continue to assume that the coming months will be the peak of US inflation and that the figures will fall steadily afterwards, dropping back below 3 percent in 2022. (...) The breakeven curve should then become steeper.»

3 June 2021: «[The higher wages in the US] are mainly due to high compensation payments by the government (...), which will end in September. (...) In the short term, [raw material] prices have already gone too far (...); we therefore do not expect any further pressure on inflation here. (...) We continue to assume that the coming months will be the peak of US inflation and that the figures will fall steadily afterwards, dropping back below 3 percent in 2022. (...) The breakeven curve should then become steeper.»

Flop

Wage pressure in the US has increased and is no longer just in the low-wage segment. Commodity prices have risen again, partly due to the outbreak of war in Ukraine, which is why inflation rates this year are well above 3%. The breakeven inflation rates remain at roughly the same level across all maturities and the curve has therefore not steepened.

Update

We continue to expect less inflationary pressure from commodity prices and a steeper breakeven curve. Wage pressures are also likely to ease due to recession risks.