Central banks knock down investors again

Both the equity and bond markets have experienced an impressive rally since mid-June, offsetting around half of the annual losses. This run was abruptly halted by Jerome Powell's speech in Jackson Hole. Our equity underweight and protection strategies have thus paid off in recent days.

Text: Stefano Zoffoli

In Jackson Hole, Powell indicated that interest rates will continue to rise sharply and that interest rate cuts are unlikely to follow soon. This caught many investors on the wrong foot, as they were already counting on the US Federal Reserve being more merciful due to the gradual reduction in inflation rates. Thanks to our equity underweight and protection strategy, we were well positioned.

Since prices on the equity markets continue to be elevated (the risk premium is merely average, at around 3.9%), further interest rate hikes are set to follow, the Fed is now actively reducing its balance sheet, the economy is shaky (the purchasing manager indices in both the USA and Europe are below 50) and September is the seasonally weakest month for equities, we are maintaining the equity underweight.

If the equity markets now price in a decline in profits across the board and inflation rates actually return as strongly as expected, equities will become more attractive again.

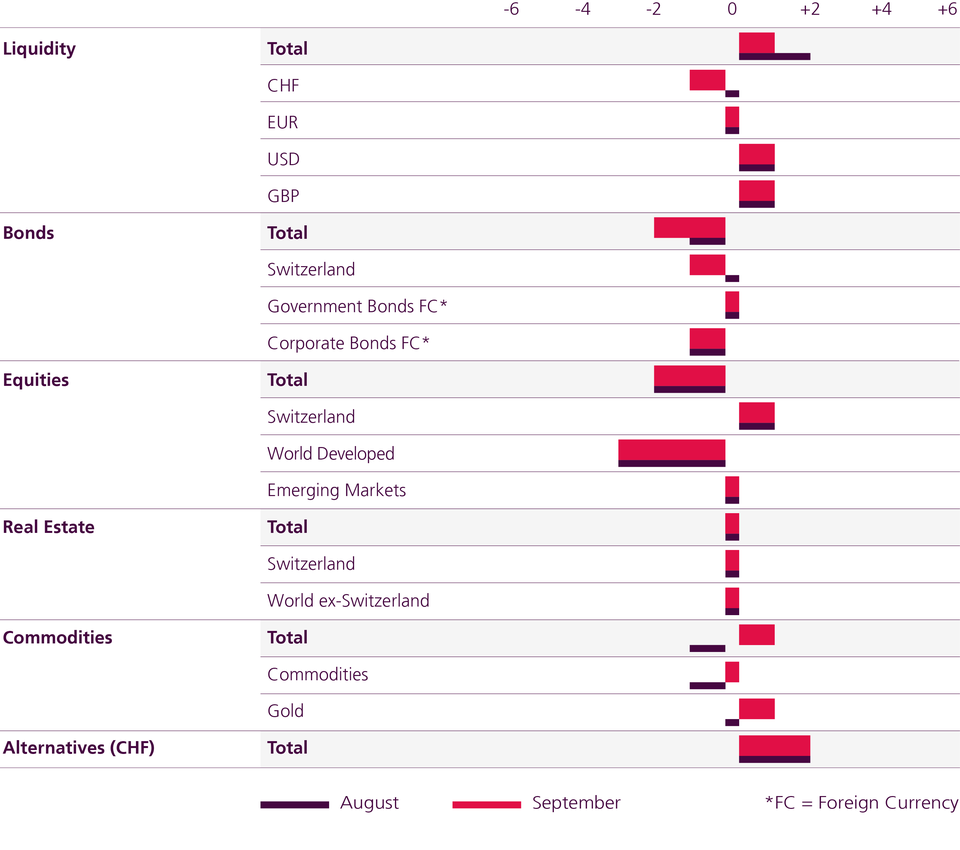

In the case of bonds, we are making a small reduction in CHF bonds, as these are now somewhat expensive again in relative terms and the economy is significantly more robust compared to Europe.

After a turbulent roller coaster ride, we are also closing our underweight in commodities, as supply concerns are again at the forefront and China is sharply increasing infrastructure spending.

- The Swiss franc has been our preferred currency to date and we had a strong overweight.

- However, the appreciation has been high (+7% since mid-June) and the franc has now also appreciated in real terms; the SNB has therefore already intervened slightly again.

- The Fed will continue to raise interest rates (target rate 4%) and delay interest rate cuts; the US dollar therefore remains attractive despite the considerable valuation.

- We are therefore redistributing our overweight to the CHF and USD and remain underweight in GBP and EUR.

- Thanks to the high oil price, energy companies are generating enormous profits, while valuations remain below average despite price increases. The EV/EBITDA has a standard deviation below the 3-year average.

- Further fundamental indicators such as the good free cash flows and the above-average dividend yield (3.7%) are positive for the sector.

- Up to now, the levels of oil prices have only partially correlated with share prices. The sector is considered the best stagflation hedge. We are overweight here.

- Gold has been trapped in a trading range (USD 1680 – 2050) since summer 2020; we are currently at the lower end again.

- Sentiment is at a low. Speculative positions have been sharply reduced, ETF flows have been negative for 11 weeks and August 2020 was already the fifth month in a row with negative performance.

- Although the fundamentals (real returns and USD) are still not necessarily positive for gold, a counter-movement is now entirely possible.

- We are buying 1% more at the current price level, but are setting a tight stop loss should the trading range not be maintained.

Multi-Assets Allocation