Stock market faces dilemma

Buy or sell? This is the question that drives stock investors. And no matter which decision they make, the risks are difficult to weigh. But there are alternatives.

Text: Stefano Zoffoli

Closing the underweight in equities at the end of September turned out to be the right decision. Equity markets rallied by +7% in October. It seems as though the often quoted "peak hawkishness" is now actually materialising.

The interest rate hikes by both the Canadian and Australian central banks were thus lower than expected in October. According to their assessment, the previous key interest rate hikes are now making themselves felt in the interest rate-sensitive areas of the economy (particularly in the housing market).

Interest rate hikes in other countries also seem to be increasingly reflected in the real economy. The instructive Purchasing Managers' Index (PMI) surveys in almost all regions are now in recession territory.

Equity investors therefore face a dilemma. Should they buy because inflation is declining and the cycle of interest rate hikes is coming to an end? Or sell because there is a threat of recession? Currently, relief that the interest rate peak will probably soon be reached is predominant. However, if inflation in the USA remains above 8% or if core inflation continues to rise, there is a risk of further losses. In this context, we remain neutrally positioned in equities and prefer global government bonds as they do not face this dilemma.

- The healthcare sector has historically been the most resilient sector in times of stagflation and tighter financial conditions.

- The outperformance has by no means yet reached the extent of past recessions (2000: 75%, 2008: 50%, 2020: 30%, currently: 17%).

- The COVID pandemic led to an increase in sales. The sector is now expecting a new phase with increasing sales thanks to individual patient diagnosis.

- We have held positions in the Nasdaq since February 2019. This has paid off extremely well with over 38% outperformance.

- Since we have been cautious about tech stocks for some time due to rising interest rates, we are now selling the position completely.

- The very strong earnings growth seems to be slowing. Big techs such as Alphabet (Google), Microsoft, Amazon and Meta Platforms (Facebook) are also feeling the strain.

- The price and earnings momentum in Australian equities is excellent. Dividend yield (5%) and free cash flow (12.1% vs. 6.8% for global equities) are very high.

- The Australian central bank is taking its foot off the brake. This could give a boost to equities. The greatest risks are dependence on China and the real estate market.

- As we expect a weaker AUD, we are hedging the foreign currency exposure in Swiss francs.

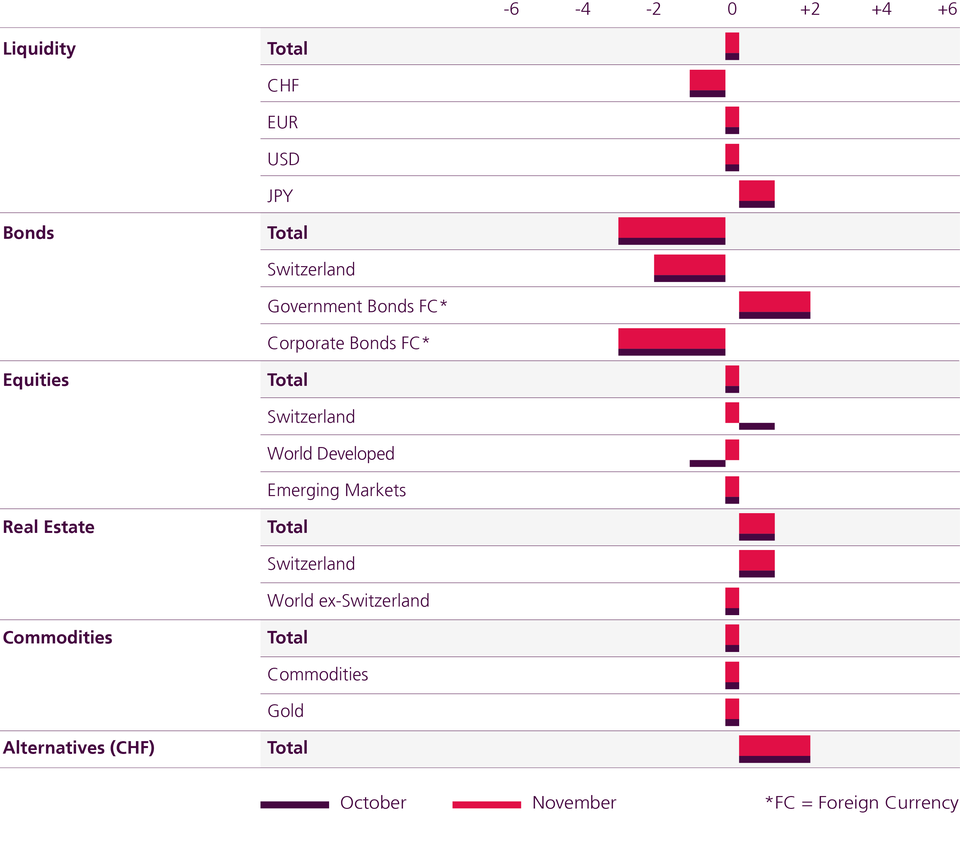

Asset Allocation November 2022