Here are the reasons for the excellent start:

- warm temperatures, with the positive effect that the energy crisis and recession in Europe are turning out to be modest,

- sharply falling inflation rates and

- the reopening of China.

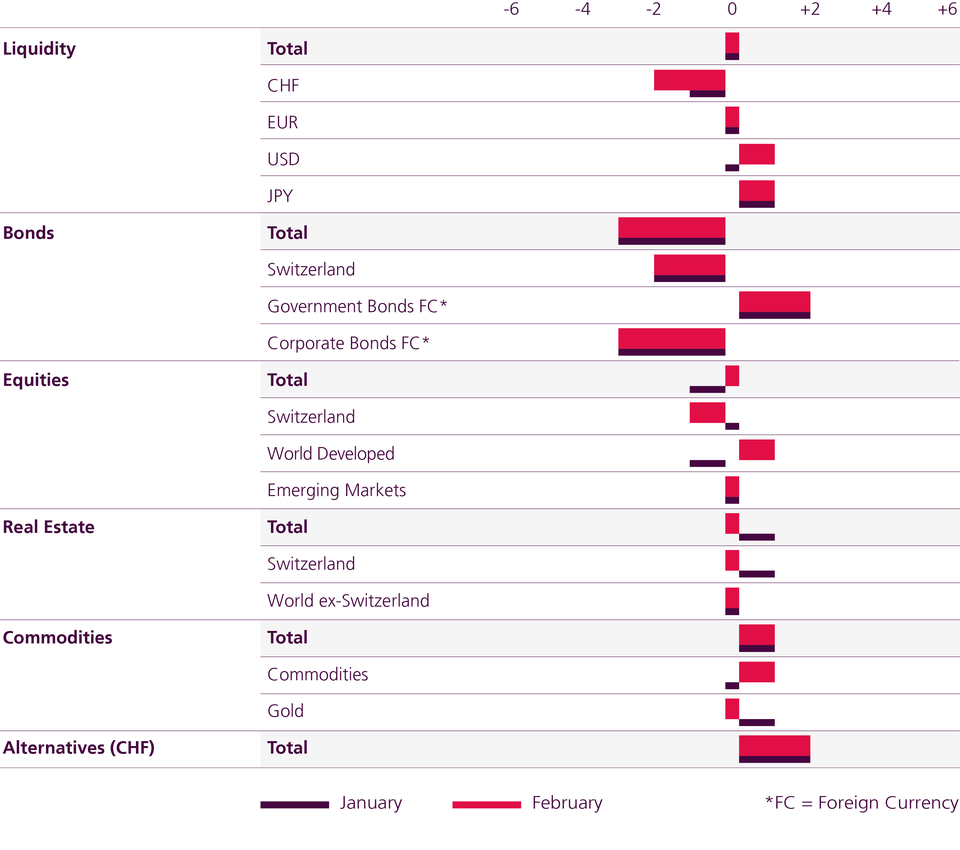

How will we position ourselves in February 2023?

We do not trust in this Goldilocks scenario quite yet. Valuations remain high for the ongoing slowdown in the economy and the prospect of interest rate cuts is too euphoric. However, as all major technical resistance has been broken and many investors continue to be defensive, we remain on the sidelines for the time being and are currently maintaining a neutral equity allocation. We remain underweight in CHF bonds and corporate bonds, and overweight in emerging market bonds. We anticipate outperformance in alternative investments. In equities; Europe and Australia remain our favourites.